Table Of Content

- Can You Get a Mortgage With a Bad Credit Score?

- Check your credit report and correct any errors

- Cheap Methods for Boosting Your Credit Score When Buying Your First Home

- The Importance Of Credit Scores During The Application Process

- Minimum mortgage credit score by loan program

- Loan-To-Value Ratio (LTV)

- Pay down credit card balances

- Disputing Errors on Your Credit Report

Homebuyers with good or excellent credit scores—from 670 to 850—typically have the best mortgage rates. You can usually check your credit score on any credit card issuer’s app or website, through your bank or other institutions where you borrow money. You can check your scores for free once a year on AnnualCreditReport.com. The higher your down payment, the more likely you are to qualify for a loan with a low interest rate, too. If you put at least 20% down and want a conventional home loan, you can avoid private mortgage insurance (PMI)—an added monthly expense to protect lenders in case you default on your loan.

Can You Get a Mortgage With a Bad Credit Score?

You'll contend with a ton of competition -- according to data from the National Association of Realtors, there was only a 2.9-month supply of homes available in February 2024. But getting into a home with less-than-perfect terms now can still make sense in certain situations. You can get a free copy of your credit report from Experian, or from each of the three national credit reporting agencies weekly at AnnualCreditReport.com. A great house hunting checklist could make the difference between getting the home you want or missing out because another buyer was better prepared. Learn more about how to figure out how much you can spend on a mortgage and use our home affordability calculator here. The lower your DTI, the better chance you have at being offered a lower interest rate.

Check your credit report and correct any errors

Experian can help raise your FICO® Score based on bill payment like your phone, utilities and popular streaming services. If you have additional questions about the best credit score to buy a house, we have answers. A jumbo loan is similar to a conventional mortgage, except the loan amount for a jumbo loan exceeds the conforming limits set by the Federal Housing Finance Agency (FHFA). While every lender is different, knowing your score and how it may impact your loan application is key.

Cheap Methods for Boosting Your Credit Score When Buying Your First Home

Whether you qualify for a specific loan type also depends on personal factors like your debt-to-income ratio (DTI), loan-to-value ratio (LTV) and income. Some conventional mortgage providers will lend to those with a credit score lower than 620. Many individuals may not realize that different FICO Score models exist.

The Importance Of Credit Scores During The Application Process

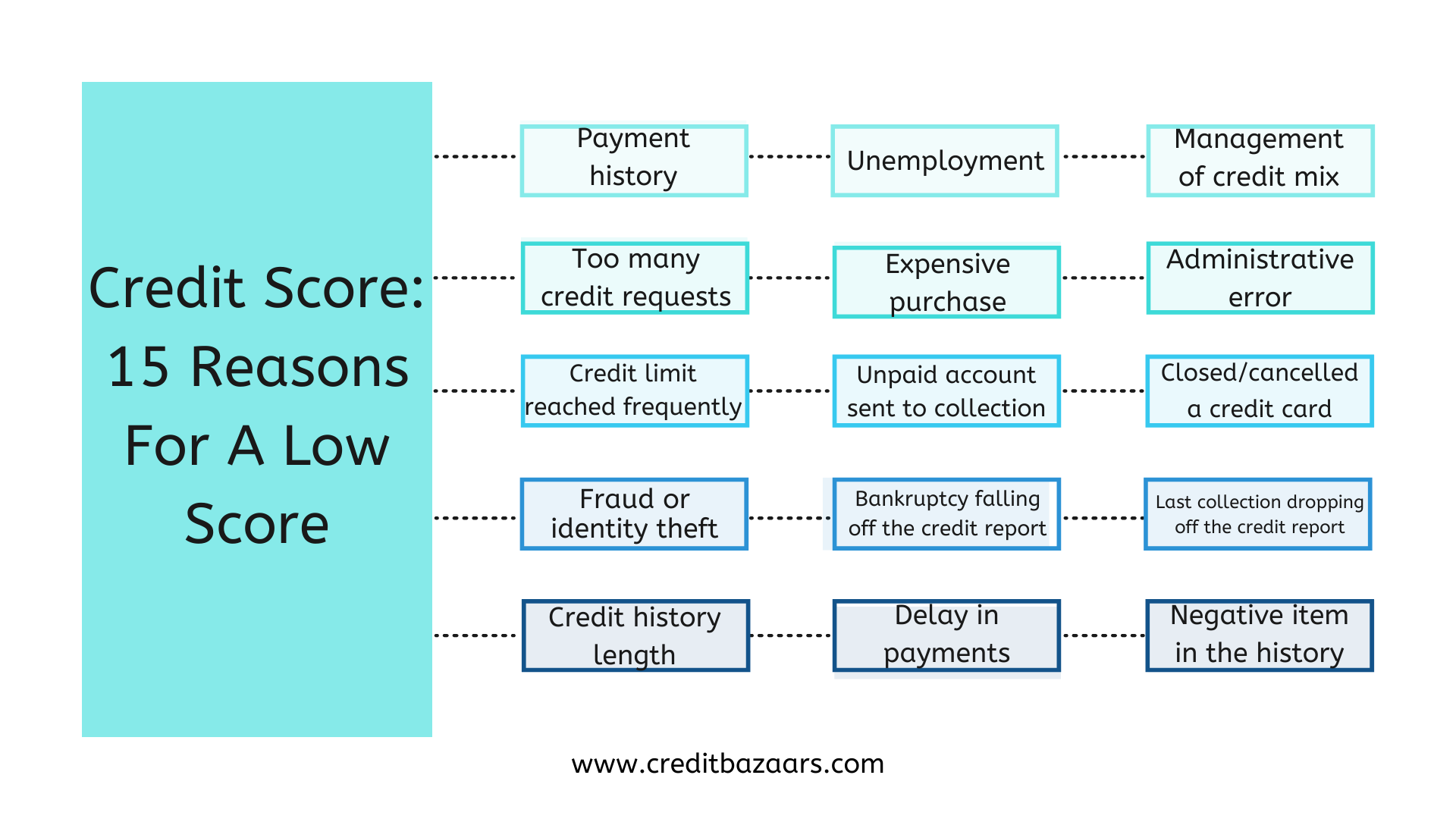

Conventional loan financing is typically best for borrowers with good or excellent credit because they require a higher credit score than government-backed loans. When you’re buying a home, your credit score is one of the most important factors lenders consider, both when determining your eligibility and when setting your interest rate. Though it’s difficult to get a mortgage with bad credit, it’s not impossible. In fact, some mortgage types specifically cater to borrowers with less-than-ideal credit. When you’re shopping for a home with bad credit, there are a few steps you can take to improve your chances of approval.

Indiana First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Indiana First-Time Home Buyer 2024 Programs and Grants.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

Minimum mortgage credit score by loan program

Conventional loans are the most common type of mortgage, accounting for about 70% of the market. They usually require a 620 credit score, though some lenders will consider applicants with scores as low as 580. Mortgage lenders typically want to see a score of 620 or better before approving a conventional mortgage. There are government-insured mortgages if your score is lower, and if your score is 760 or higher you'll qualify for the best interest rates.

Many lenders will issue government-backed FHA and VA loans to borrowers with credit scores starting at 580. Some lenders even offer FHA loans with a credit score as low as 500, though this is far less common. In addition to your current credit score, lenders scrutinize your credit history when considering your credit score to buy a house.

In addition to determining which mortgage program you’re eligible for, lenders use credit scores to assess a borrower’s risk of default. Higher scores suggest a smaller risk of missed payments and foreclosure so it’s easier to qualify for a lower interest rate. Your mortgage lender will first look at the type of loan you are applying for to determine the minimum credit score to qualify as well as your down payment amount. For example, on a $300,000 mortgage, the difference in principal and interest payments between a 7 percent interest rate and a 6.5 percent rate is $99 per month. That comes out to more than $35,000 over the course of a 30-year mortgage term.

Swap rates are based on what the markets think will happen to interest rates in the future. They borrow from financial markets and often these transactions are made using Sterling Overnight Index Average (SONIA) swap rates, which can move around. The Kansas-based mortgage company was established in 2000 as Mortgage Lenders of America and acquired in 2018 by Zillow Group.

And a lower DTI could make it easier to qualify with your current credit score. Additionally, a more affordable home may allow you to make a larger down payment, which will reduce both your LTV and your monthly payment. The mortgage process varies slightly depending on your lender and loan type.

Because the minimum qualifying score for conventional loans is 620, this can mean the difference between qualifying for a mortgage and not. Department of Veteran Affairs, VA loans are designed for current and former servicemembers and their spouses. No down payment is required and, while most lenders will want a 620, the VA doesn't set any credit score requirements.

The credit score needed to buy a house varies depending on the type of loan and the lender’s requirements. Your lender wants to be sure that you maintain a steady income and consistent employment. Lenders often ask borrowers for documents that validate their income, assets and work history. These documents may include recent bank statements, pay stubs and W-2s.